April 4th, 2023 by J B

Are you paying too much; part 2

Filed in: Merchant Accounts |

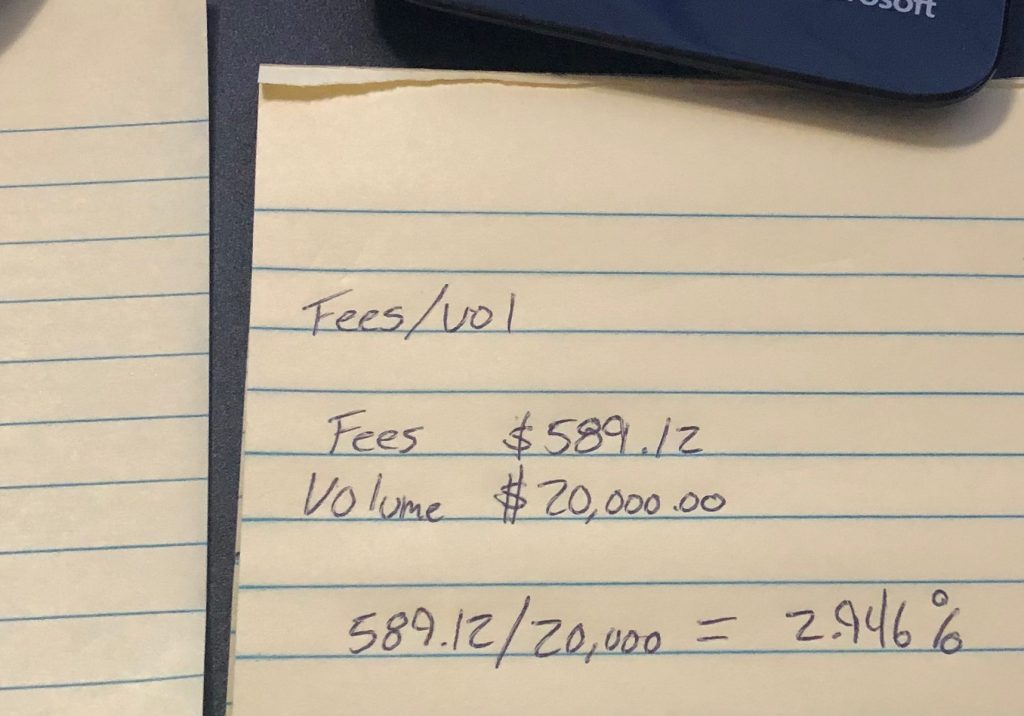

In our previous article we were looked at calculating your effective rate and getting a baseline for current payments cost per dollar of processing volume. In this article we will cover things like average tickets and how they can have a profound effect on your processing costs and of course on your effective rate.

Lets start by diving into you average ticket. Each transaction through your merchant account is effected by two different costs, a discount fee based on the dollar volume and a flat transaction fee. The higher the dollar amount of each transaction the more your costs are effected by the discount rate. The lower the dollar amount of your transaction the more you costs are effected by the flat transaction fee. Basically the lower your average ticket the more important it is to focus on lowering your flat transactional fees.

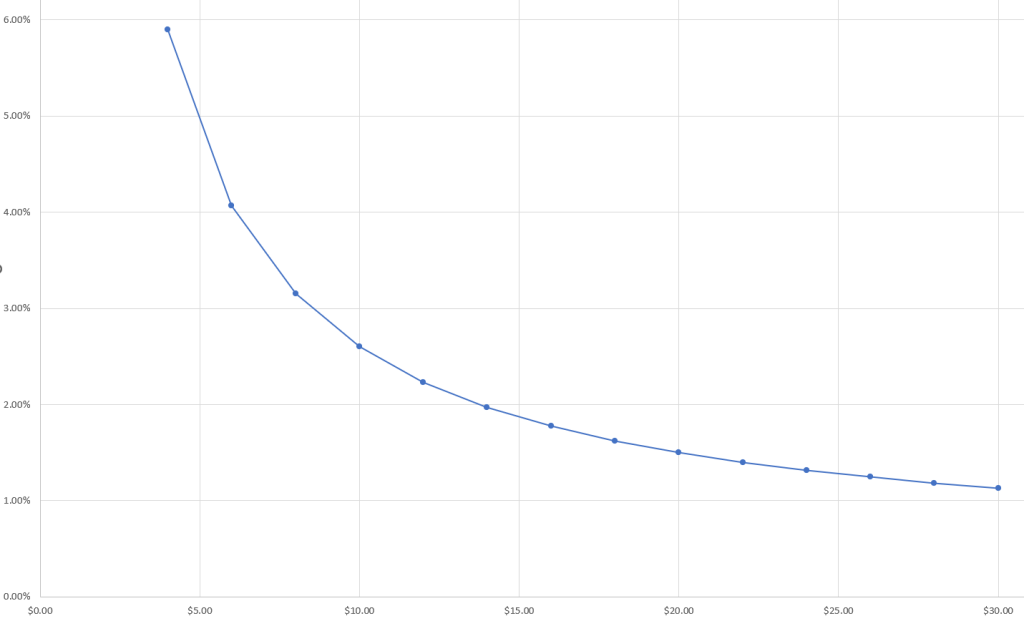

Lets take a look at an example just looking at the interchange costs. This example will be on the higher end but it illustrates the point nicely. If your business has a $5.00 average ticket and you accept a regulated debit transaction the interchange fees on that are capped at 0.05% + $0.22 per transaction. That 0.05% discount fee is effectively $0.0025 in cost. That $0.22 transaction fee is effectively 4.40%.

If we then add on fees from your processor things get worse. If you processor is charging you 0.35% + $0.10, then your looking at an additional $0.0175 in discount fees plus the flat $0.10 transaction fee. That flat fee is effectively 2.00%.

Combine you are looking at a rate of 0.40% + $0.32 per transaction. You are basically paying $0.34 per transaction in this case, or 6.8%. Now take this same scenario but with a $7.00 average ticket. You would then be paying $0.348 per transaction or 4.97%. Expanding that ticket size to $25 the effective cost becomes $0.42 per transaction or 1.68%.

I know I just though a lot of numbers out there, so here is a chart that represent different ticket sizes vs those same rates.

There are a few things you can do with this information. If your average ticket is less than $12.00 then the most cost effective this you can do is increase your average ticket. Sure you could go try to get a couple cents off the processor per transaction which would help, but not nearly as much as increasing ticket sizes.

This also helps you identify where to not waste your time if you are going to be negotiating with a processor. If you average ticket is $30+ your costs are going to mainly originate from the discount fees. If you have to eat an extra penny per transaction to get 0.10% off your discount rate then you are coming out ahead by doing that vs paying 0.10% more and saving the penny.

Next article we will take a look at transaction types and how those will effect your processing fees.