November 20th, 2018 by J B

How to lower your credit card processing costs, without ever calling your processor

Filed in: Monthly Newsletters |

In our last article we covered how to get your effective rate to better understand what your credit card processing costs vs your processing volume.

Here we are going to take a look at some adjustments that can be made to help lower your effective cost just by making some changes to your operating procedures. With some operational changes you can make an immediate impact on your processing fees. While most business are not going to be able to use all of these methods, even implementing one of the following can do a lot to bring down your effective processing costs.

Increasing Ticket Size

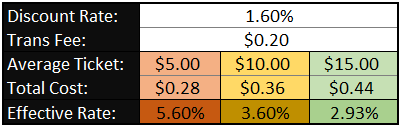

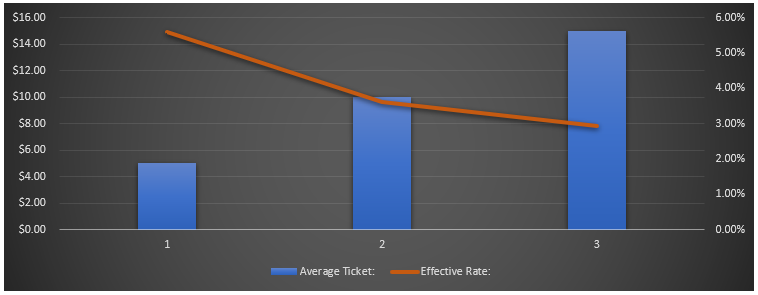

One place to start would be looking at your average ticket size and seeing if increasing it will have a significant effect on your processing statement. The lower your average ticket, the more effect increasing it will have. To understand how this works we should take a look at your processing fees which may be made up of a flat per transaction cost and/or a percentage rate. On lower ticket amounts the transaction fees accounts for a higher percentage of your sale amount than the processing rate.

Here is a quick example of the effect of increasing your ticket size has on your effective rate.

Here are a few ways to increase average ticket size.

We are going to list a few of the common ways to increase your average ticket, but don’t be afraid to step outside the box. We have seen many businesses roll out some unique strategies that have done wonders for increasing ticket size.

Bundle Items:

Bundling items will help increase overall sales when done correctly and for our purposes here, bundling will also help push up your average ticket. Quick services restaurants have used combos for years to help increase the amount of food and drinks server. That said it doesn’t just apply to quick service, you can do the same sort of bundling in retail.

While with most retail ticket sizes will be higher you can bundle smaller items to help increase your overall average ticket size.

Add Impulse Items at checkout:

The impulse purchase can be a powerful tool. Adding low cost items at the point of sale can help drive higher tickets. You see this everywhere from the convenience stores and grocery stores to clothing stores and mechanics. Take some time to consider what items would appeal to your specific customers.

Offer Discounts on multiple items:

If you can sell one thing, maybe you can sell two. There is a local automotive repair place in town that offers discounted oil changes if you purchase two or more at a time. In their case, it’s much more about building return customers, but you can do the same while helping to increase ticket sizes.

There is also a favorite donut shop in town that heavily advertises discount for ordering multiple of the same item, allowing them to more efficiently move products and improve their processing costs.

Up Sales and Add-ons

This staple of the fast food industry shouldn’t be overlooked by other business types. Train your staff to know what products or services go together, and to watch for what products are typically purchased together.

Being able to suggest something a customer might be missing from their purchase is just good customer service. Better yet it increases your ticket size.

Gift cards are a great up sale, and way to increase ticket size. They also in-affect accomplish most of the points above in one transaction. They help to build customer loyalty, increase transaction size, increase total customer spend, and generally you are charged a lower flat fee per transaction when compared to standard credit card fees.

Tips can effect your processing rate

All kinds of businesses accept tips, but many don’t realize that it can affect the processing rate charged on a transaction. In the processing industry, only a few business types are routinely acknowledged to accept tips, and even then there are limits. Basically if you’re a restaurant, bar, or saloon, tipped transactions generally won’t increase your discount rate as long as its under 20% of the original sale amount. If your are any other business type tips are essentially not supposed to happen.

And, sometimes tips organically exceed 20% of the original sale amount, and some business allow their employees to receive tips on credit cards. In those instances your processing fees may increase. There are a few things you can do help keep these costs down.

Counter Tip

Counter Tip is a popular alternative to the restaurant normal tip-line on the receipt. With Counter Tip you present a receipt with a tip line before processing the card payment. The card holder can then fill out the tip amount and total and return the receipt with their payment card. When running the transaction you would enter the total payment amount, including the tip, that way the sale is processed with the original authorized amount including the tip. This avoids the transaction costing more due to the tip amount.

Many credit card terminals support this feature out of the box, however some will need to have a configuration update to enable it.

Ask for a tip before finishing the transaction

Similar to counter tip, just asking before processing the sale allows you to enter the total amount entirely avoiding a tip adjustment which can increase your costs.

Cash Tips

Make it known that cash tips are appreciated. The more you move tips to cash, the better. Even when you are getting the best possible rates, you are still paying processing fees to accept a tip. If you are passing those tips directly to your employees then the business is paying fees on money it did not collect.

Proper use of your point of sale

The way you process and handle sales can cause your transaction cost to increase. While this is not an exhaustive list these are the most common things business do that increase their per transaction expenses.

Settling properly

When you run a transaction on your terminal and you receive an approval, no money has moved. Basically at this point the issuer has just reserved those funds for your business. The authorization is only good for a limited period of time and needs to be settled in order for your business to collect those funds.

There are two important time-frames for authorizations. The first is 24 hours from initial authorization. If a transaction is older than 24 hours when it is settled, it can cause the cost to increase. The second time-frame is the expiration of the authorization which depends on the several factors, but general rule of thumb is 7 days. Once an authorization has aged beyond 7 days, not only will the costs increase, but you will also have a higher risk of a dispute by the card holder or the issuer.

Ignoring prompts

When you run a transaction and your terminal prompts for an address or zip code or tax amount, do you ever just leave those blank? If so, it is almost definitely costing additional money.

Conversely, you should take note if your terminal is not prompting for an address or zip code when keying in a transaction. It should be prompting every time you key a sale.

Not all prompts affect the rate charged by issuers and processors however, some do, and it’s important to enter that information not only to keep your rates down, but also to help verify the card holder is who they say they are.

Just a quick heads up, with the address prompt, you only need to enter the numerical portion of the address, not the entire street name, suite, apartment, unit, etc..

Swipe / Chip read everything

You want to be accepting using the chip on every possible card. While not all businesses are going to have physical access to the card but if you can process using the chip, do it, and if you can process by swiping, do it. Not only does this help keep your processing costs down, it is also much more secure. If you accept a stolen card and it was processed using the chip then the card issuer is much more likely to be responsible for liability in case that card is stolen. If you don’t use the chip, then your business is almost always responsible.

Pin Debit?

This is a touchy subject and depends on your average ticket, rates, networks, and location. More and more, debit networks are increasing their pricing and are closing in on or exceeding credit and debit card costs. Also, PIN-Debit may have a higher transactions fees, and now monthly fees, which can end up costing more. Some networks will charge $5 or more dollars per month even if you only accept a single PIN transaction. Further more some PIN-Debit networks will also charge an annual fee if you have accepted one of their card types.

Since the interchange rate on large bank debit cards has cap at $0.05% and $0.22 per transaction it may not bring any savings at all, or it may be more expensive for many merchants.

That said it’s still possible that PIN-debit can save money but it’s very specific to the business and the type and number of PIN transactions they are accepting.

Additional thoughts on lower expenses

For many merchants, more savings can be had by making changes to how they accept card payments, than specifically by lowering rates. It’s important to work with a team that is serious about helping you lower your costs. You should be able to contact your processor and ask them what things you can do to help lower your own costs. If they can’t suggest any improvements for your business and they can’t tell you why then it’s probably time to start seeking a new provider. Your business may be doing everything as efficiently as possible, but they should be able to point this out and explain how what you are doing is the best possible practice for your particular business.