January 16th, 2019 by J B

Is PIN Debit actually cheaper than Signature Debit?

Filed in: Monthly Newsletters |

Its be long believed by many that PIN debit transaction are cheaper than signature debit and while that may be the case in some instances that is not always the case.

First off a quick clarification, signature debit is when a customer’s debit card is accepted just like a credit card without having the customer enter their PIN number. Conversely, a PIN debit transaction is when the debit card is accepted and the customer enters their PIN as they would do at an ATM machine.

Short answer:

If your ticket size is less than $50, you’re probably better off running a transaction as signature debit. If your ticket is higher than $50 you’re usually better off with PIN debit. The biggest savings as a percentage of the transaction will be on the smaller ticket sales.

For example if you have a $5.00 sale and your PIN debit transaction cost is $0.50 then you’re paying 10%. That same transaction with signature debit could cost you about $0.23 which is more than a 50% savings over the PIN Debit Fee.

But there is a lot more to it than that..

Cost Drivers:

There are 3 primary drivers of cost when talking about debit transactions. The first is going to be whether or not the card being accepted is a regulated or unregulated debit card. The second is which network is being processed through. Finally, the third is the dollar amount being processed. You can look at these three areas to work out a rough idea of your possible costs.

Regulated and Unregulated Cards:

The Durbin amendment set a price cap of effectively 0.05% + $0.21 for cards issued by banks with more than $10 billion in assets. The amendment allows for an additional $0.01 per transaction to be charged in most cases. For issuers under $10 billion in assets there is no regulation as to what they can charge to move funds.

With regulated cards having a $0.22 transaction fee from the network, small tickets are going to have a higher effective cost than unregulated until the transaction amount is above $7.00. For transactions beyond $7.00, regulated debit cost is by far cheaper than unregulated.

Unfortunately, you’re not going to be able to tell what cards are regulated or unregulated. That being the case we are going to focus the rest of this article on unregulated cards where the other two cost drivers come into effect.

Unregulated Network Pricing and Ticket Size:

Each payment network prices transactions differently, however higher dollar transactions will end up with the lower effective cost. No matter if you are accepting PIN or signature debit, if you can increase your per transaction amount, it would be in your best interest from the perspective of effective cost.

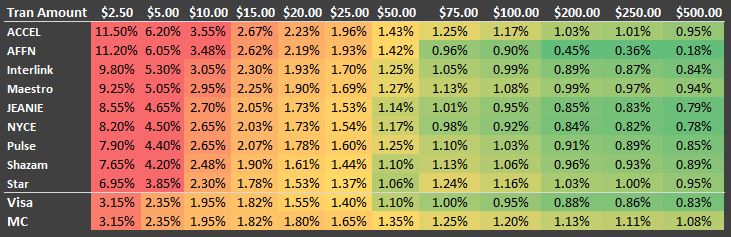

The table below shows a breakdown of the network cost for a single transaction between $2.50 and $500. The first 9 networks represent the effective cost per transaction on PIN Debit. The lower two show the effective cost of processing the same transaction as signature debit.

As you can see, when look at just the network fees, signature debit is effectively the lowest priced option until between $25 and $50 transactions. At $50.00 and higher, the debit networks begin to consistently a cheaper way of accepting the card. With that in mind notice that PIN Debit is at most a savings of 0.30% on a $500 ticket. That’s not a huge savings on one transaction but on a month of volume it can really add up.

The biggest take away here would be for merchants with very small ticket sizes. It would be in their best interest to avoid PIN debit. As a percentage of the transaction amount, signature debit would be their most cost effective option.

Another Important consideration:

Before making changes to how you accept payments just based on your per transaction size, take a look at how much regulated debit you are accepting now. Review your merchant statement or ask your processor about your regulated debit volume.

While you’re at it check and see what your processors is charging you for regulated, and unregulated debit. Make sure to specifically as about signature and PIN debit rates for both transaction types.

You might find that you accept a lot of regulated signature debit, but your pricing on those cards is the same as unregulated, meaning you are not seeing any of the cost savings of those transactions. You might also find that other transaction fees make one transaction type less cost effective that it should be. If this is the case its probably time to re-evaluate your current setup and see what other options are available.

If you have any questions understand a processing statement feel free to reach out to us at 800-898-3436, and we will do breakdown and explanation on any merchant processing statement. You can also email us.