June 16th, 2016 by MSI Newsletters

Capital Advances

Filed in: Monthly Newsletters |

Are you looking for money to expand your business, add inventory, purchase new equipment, or do renovations? A capital advance could be a helpful tool to expand your business and are much easier to get than more traditional forms of small business funding. There are two sides to every coin however and it’s important to know that this option does tend to have a higher overall cost. If your business is looking for funding it would be a good idea to review this options and see if its good fit for your business.

How it works:

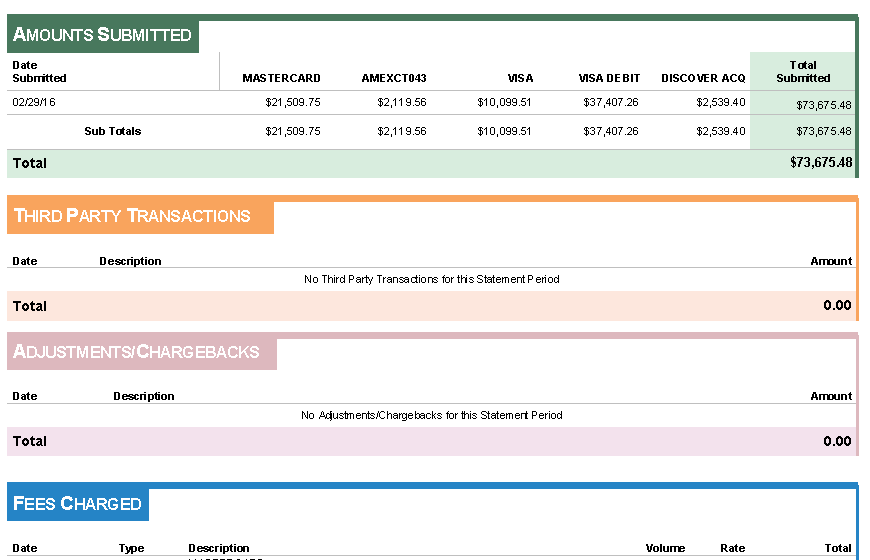

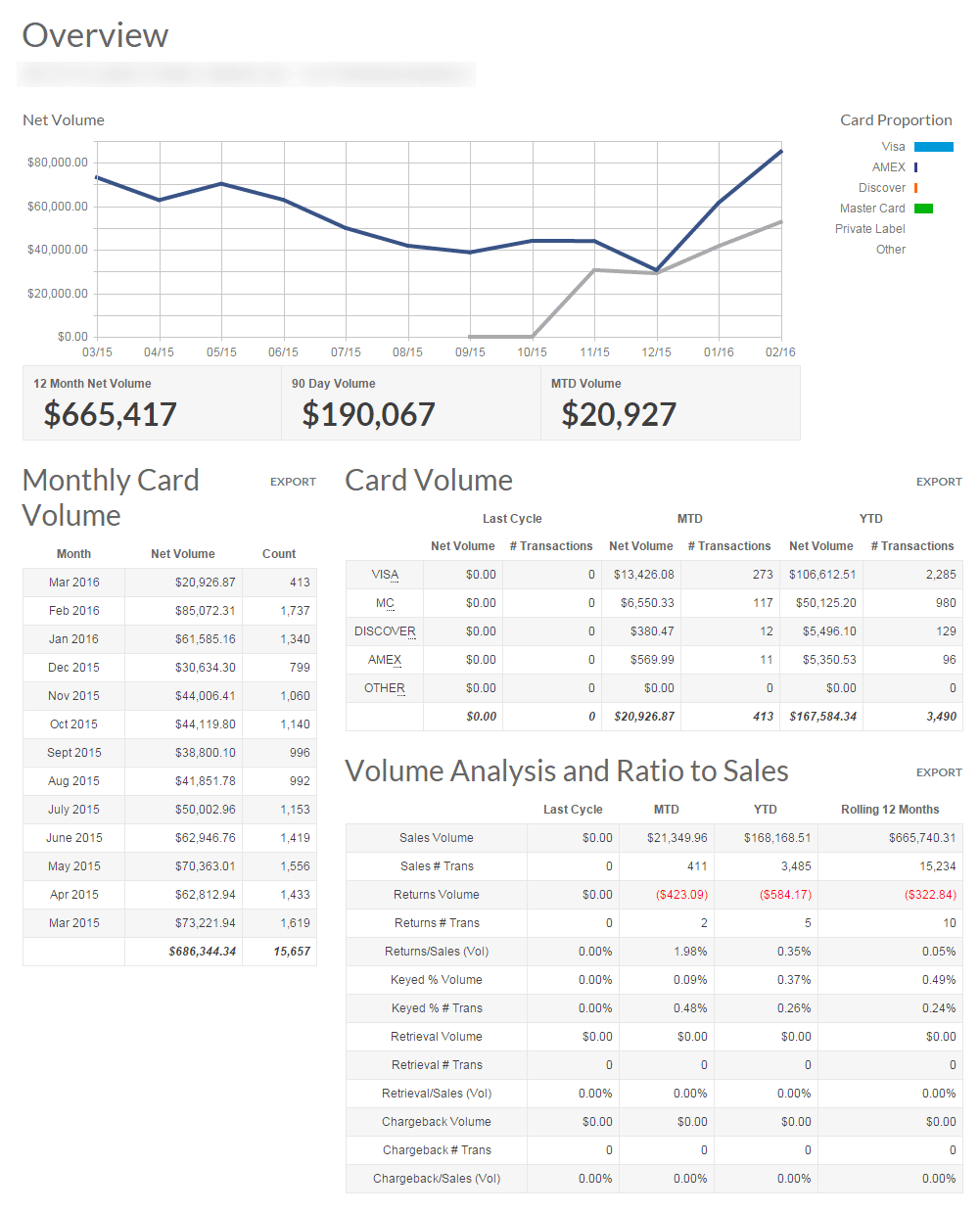

Unlike a loan where you are borrowing money that then needs to be paid back in regular amounts and on regular intervals, in a capital advance your selling your business’s future receivables for cash today. Once your account has been funded we will take a small portion of each batch you process until the advanced funding is paid back. That means no fixed monthly costs, your automatic payments fluctuate with your credit card processing volume.

Application Process:

capital advances are based on your monthly credit card volume and ranging from $5,000 to $1 million. Most capital advance options out there are designed to have a simple application process with no application fee and no obligation accept the funds once approved.

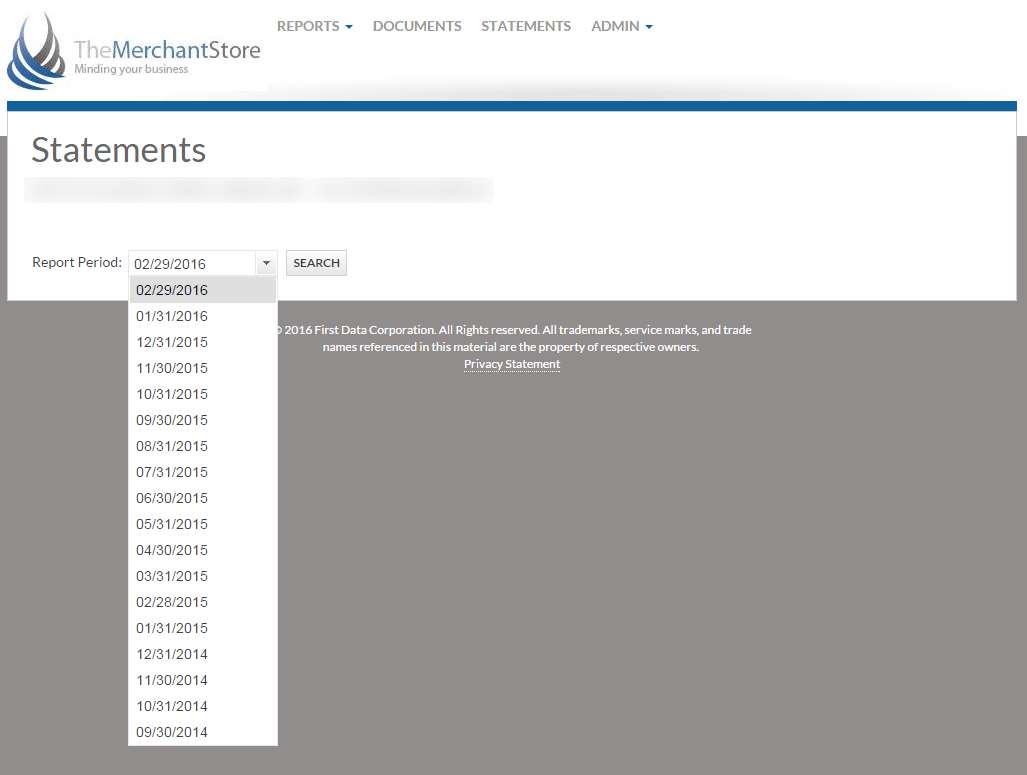

While I can’t speak for other companies offering capital advances, at The Merchant Store once you complete our one page application you will be contacted within 24 hours by a funding specialist who will discuss the funding solutions with you. We can have funds deposited in your bank account in as little as 5 business days from receiving the application in most cases. See below for our approval criteria.

Approval Criteria:

- Monthly credit card volume: $5,000 or greater

- Business age: Greater than 12 months

- Tax liens: $20,000 or less

- Bankruptcy: Older than 12 months

- Primary residence: Must not be in foreclosure

- Business rent: No more than 30 days delinquent

- Bank account: No frequent overdrafts

- Business location: Not home based

- Average ticket: $600 or less

- Capital advances: No previous capital advances in past 60 days.

If you interested in more information about our capital advance options please contact us at (888) 528-0058 and we will help you get started.

capital advances: No previous capital advances in past 60 days.

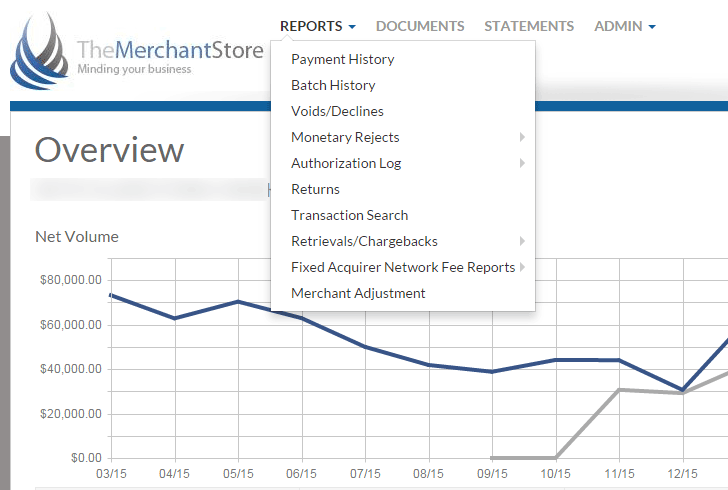

Gateways aren’t just for e-commerce

The primary function of most gateways in the past was to handle a credit card transaction between a business shopping cart and their processor. These days however many gateways offer advanced features that can meet the needs many business types. Below are a few key features that apply to many different business types.

QuickBooks Integration

If you are using QuickBooks to process your credit card transaction you are most likely using Intuits credit card processing. Many gateways, including our own, now integrate directly with QuickBooks which give your many more options when it comes to credit card processing. These integrations can also include the ability to access other features in the gateway right from Quickbooks. See Customer Vault, and Recurring Billing below. Also if you are processing with Intuit and have not reviewed what you’re paying them to process your transactions recently I suggest you start seeing what other options are available to you.

Customer Vault

This feature allows you to store you customer’s credit card data in the gateways secured environment so you can access it for rebilling without having to request the credit card details for each returning customer. This ability to keep a card on file lowers risk of error, and makes transactions much easier for both the business and their consumers.

Recurring Billing

For businesses that have customers who are on service plans, memberships, or any other type of regular payment recurring billing allows you to automate the payment process. You can set recurring amounts per induvial customer or create plans and assign your customer to the billing plan that your agreement. This can be a great time saver for many businesses.

Mobile Processing

Processing transaction on a Smartphone is an easy, and low cost solution for mobile merchants. Our gateway allows you to add multiple smartphones, tablets, and computer to their system so you can run transaction anywhere from your device. Whether you just need access to hand key a transaction every now and again, or need to be able to swipe a credit card at a high place trade show, this is a flexible option without the cost of the traditional wireless terminal.

Invoicing

Our gateway gives you the ability to invoice your customers and provides a direct link to make payment. Just a few clicks and your customer has an invoice in their inbox, and they are just a few more clicks from finalizing payment. While you don’t have to customer the look of the invoice or the payment page, you have the ability brand everything so it fits your business.

These features are just a small handful of what the MSI Gateway offers, and can be mixed and matched together to fit any business needs at a very affordable price. Our gateway service, including a virtual terminal and recurring billing starts at $8.00 per month and $0.08 per transaction. If you are interested in hearing more about the gateway features here or any additional features please contact one of our representatives at (888) 528-0058 or visit our website.

Part 2 of our series on fraud, covers some tips to help identify and prevent the damages from fraud. Many forms of fraud can be prevented by proactive policies and often with common sense. While some schemes are so well planned that even seasoned professionals have a hard time identifying it, many types of fraud follow recognizable trends and can often be prevented. Here are some tips to help identify, prevent, and mitigate fraud.

Part 2 of our series on fraud, covers some tips to help identify and prevent the damages from fraud. Many forms of fraud can be prevented by proactive policies and often with common sense. While some schemes are so well planned that even seasoned professionals have a hard time identifying it, many types of fraud follow recognizable trends and can often be prevented. Here are some tips to help identify, prevent, and mitigate fraud.