October 7th, 2014 by Jamie Estep

Credit card logo generator and API – Updated

Filed in: Ecommerce, Merchant Accounts, Tools | 11 comments

Update 10-2014 – Added Apple Pay logo/icon. Next update will include fully dynamic sizing options. Stay tuned.

Update 11-2013 – Added transparency option. Just omit the bgcolor from the url and the background of the logos will be transparent. This allows the logo to match any background color they are placed on without trying to match up HEX colors.

Update 05-2013 – Added Bitcoin and Google Wallet.

Update 03-2013 – Added Skrill, Verified by Visa, and Mastercard Secure Code logos.

Update 08-2011 – Added ebillme and 2checkout.com logos.

We’ve just completed a simple credit card logo generator and have included an API for web designers to use as well.

The API supports different logos for card issuers, paypal, google checkout and a few other. A developer can use the API to specify the size, background color and the order of the logos that they need on their website.

Here’s a quick tutorial and a few examples of how to use the API.

- Create an image tag with the root url: https://www.merchantequip.com/image/

- Next either leave the parameter bgcolor blank for the logoes to have a transparent background, or add the bgcolor parameter to specify a 3 or 6 character HEX background color for your logo. If you do not know the background color: FFF is white, 000 is black. Here is a full HEX color chart. There are also a variety of browser addons if you need to match the exact colors of your website.

- Next specify the actual logos that you would like to add to your site, in the order you would like to display them. Separate the logos with a pipe | character. Example: v|m|a|d for Visa then MasterCard followed by Amex and Discover.All of the available logo codes are:

- v = Visa

- m = MasterCard

- d = Discover

- a = Amex

- g = Google Checkout

- p = Paypal

- bml = Bill Me Later

- ec = eCheck

- jcb = JCB

- dc = Diners Club

- s = Solo

- me = Maestro

- mb = Moneybookers

- az = Amazon Payments

- in = Interac

- ebm = eBillme

- 2co = 2checkout.com

- vbv = Verified by Visa

- msc = Mastercard Secure Code

- sk = Skrill

- bit = Bitcoin

- gw = Google Wallet

- apl = Apple Pay

- Finally specify the height of the logos. The images currently come in 32px and 64px, so size accordingly allowing for a small margin around the images. We will be allowing for dynamic resizing in the future, but for now the only 2 sizes supported are 32px and 64px. Any additional height will be added as a margin.

The actual image url should look like (these are all generated through this exact API):

https://www.merchantequip.com/image/?bgcolor=FFFFFF&logos=v|m|a|d&height=32

The image HTML will look like:

<img src=”https://www.merchantequip.com/image/?bgcolor=FFFFFF&logos=v|m|a|d&height=32″ />

The logo above will display as:

Here’s the same logo using the larger image sizes:

Here’s all of the currently available logos:

While this tool is free to use we greatly appreciate a backlink or credit if you are using images that are hosted through the API. These images are all served securely over SSL, so they may be used on secure/SSL websites and ecommerce sites without errors.

If you have no idea of what an API is or just need logos for your website, please use the credit card logo generator and ignore this post.

Thanks again.

Having to find a replacement terminal, Verifone has recently introduced

Having to find a replacement terminal, Verifone has recently introduced

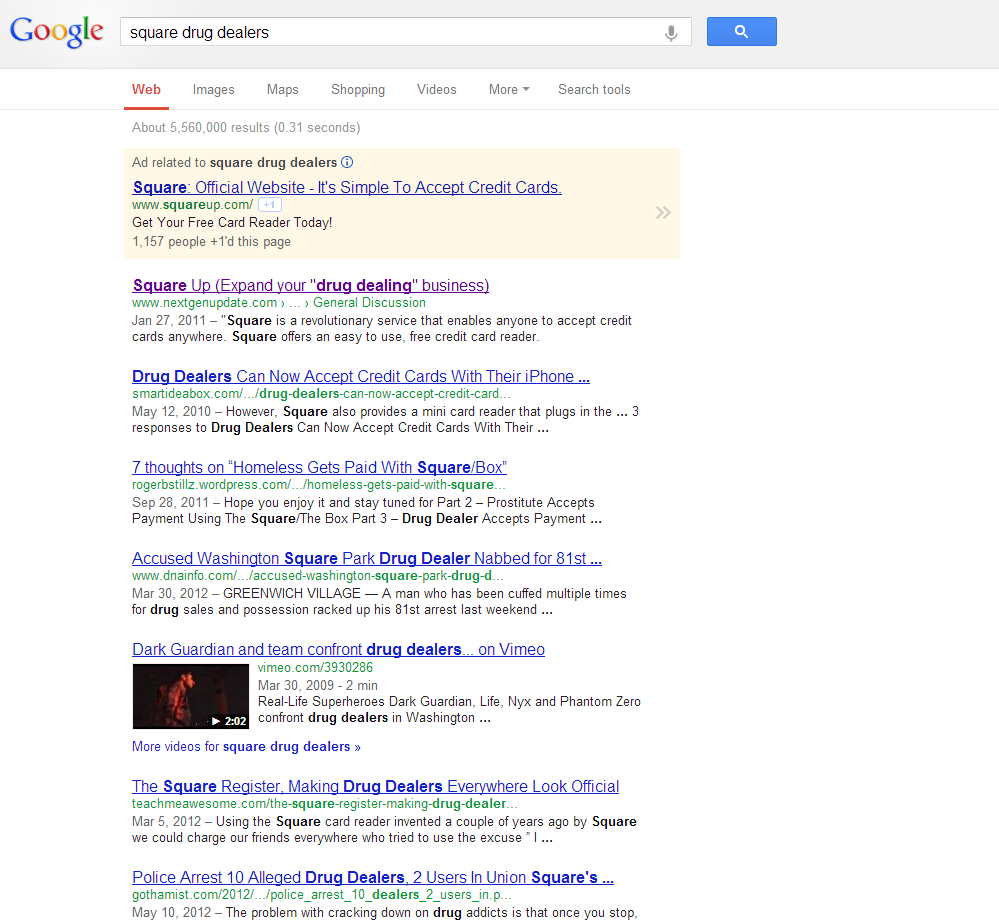

What this basically means is that Square is not operating within money transfer regulations by Illinois’s interpretation of Square’s practices. Much of this is directly focused on anti money laundering regulations. It is extremely easy to setup an account with Square and there are numerous reports and even instructions on how to

What this basically means is that Square is not operating within money transfer regulations by Illinois’s interpretation of Square’s practices. Much of this is directly focused on anti money laundering regulations. It is extremely easy to setup an account with Square and there are numerous reports and even instructions on how to