November 26th, 2024 by J B

Payment Card Settlement – Extension

Filed in: Merchant Accounts |

We wanted to give an update to businesses who might be interested in filing claim as part of the Payment Card Settlement. While we don’t have direct involvement with the settlement, we’ve been receiving numerous requests from businesses asking how to submit their claims. In this article, we’ll briefly explain what the settlement is, who is eligible, how to file a claim, and what to do if you think transaction information is missing from your claim profile.

What is the Payment Card Settlement?

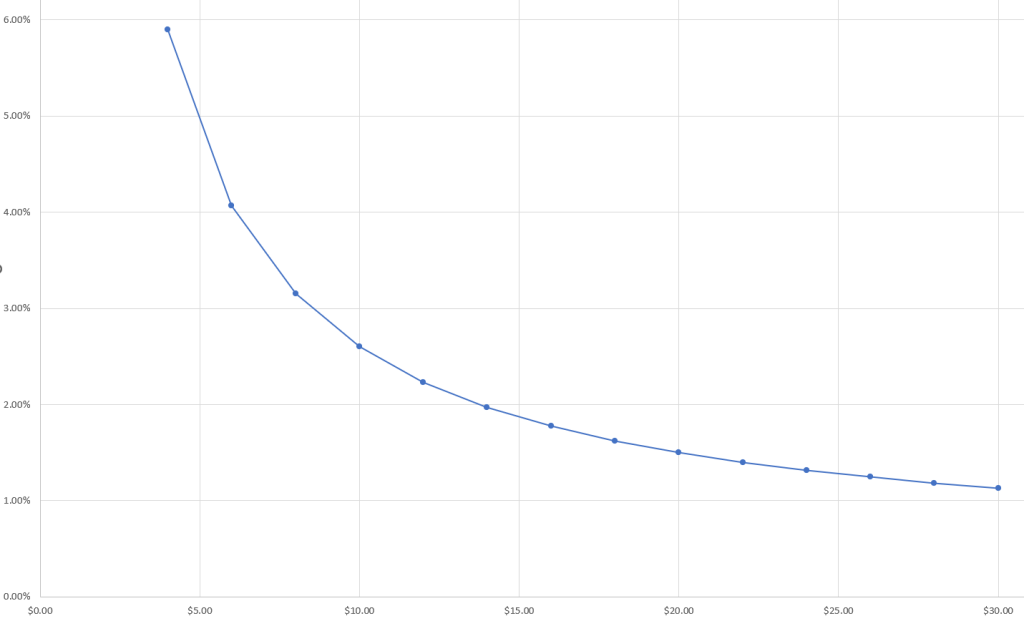

In December 2019, the District Court for the Eastern District of New York granted final approval to settle the Payment Card Interchange Fee and Merchant Discount Antitrust case. This settlement means that any business that accepted Visa and MasterCard brand cards in the United States between January 1, 2004, and January 25, 2019, is eligible for relief. The settlement addresses the long-standing issue of high interchange fees, also known as swipe fees, charged by credit card issuers. Merchants who file a claim can receive compensation for past overcharges and benefit from reduced fees moving forward.

While the original deadline to file a claim has passed, the court has granted an extension until Tuesday, February 4, 2025.

How Do I File a Claim?

There are a few ways to file a claim.

- The two primary ways to file a settlement is through the settlement portal, www.paymentcardsettlement.com by clicking on the Submit A Claim button.

- If you received and have your settlement notification card you can use the Claimant ID and Control Number to start the process.

- If you do not have your claimant notification, you can use the Provide TIN option on that same website. The site may ask for additional verification information, which maybe as simple as providing a current processing statement.

- A secondary method would be hiring a third party firm to handle your claim. Some processors have setup relationships with firms to assist their merchant for a fee, however you can also search around to find other such vendors.

On a recent webinar hosted by the paymentcardsettlement.com they did claim that a third party is likely to have no additional information than you already possess, but that some people would just rather have someone else handle it for them and that’s ok as well.

What If I Had Multiple Businesses During That Time Frame?

The claimant information is tied to your Tax ID Numbers (TINs). If you had businesses with separate TINs, you will need to file a claim under each TIN. Each claim will populate with that business’s processing data.

What If the Data Shown for My Business Doesn’t Appear Complete?

It’s uncommon for data to be missing from a business’s report. If you think data is missing, log in to your settlement portal and request additional research. On a recent webinar, they mentioned that providing your past merchant account numbers is the most helpful thing you can do. The settlement team already has the data and is working on linking it back to business TINs. If you can obtain your past account numbers, they can use that data to link all your past volume.

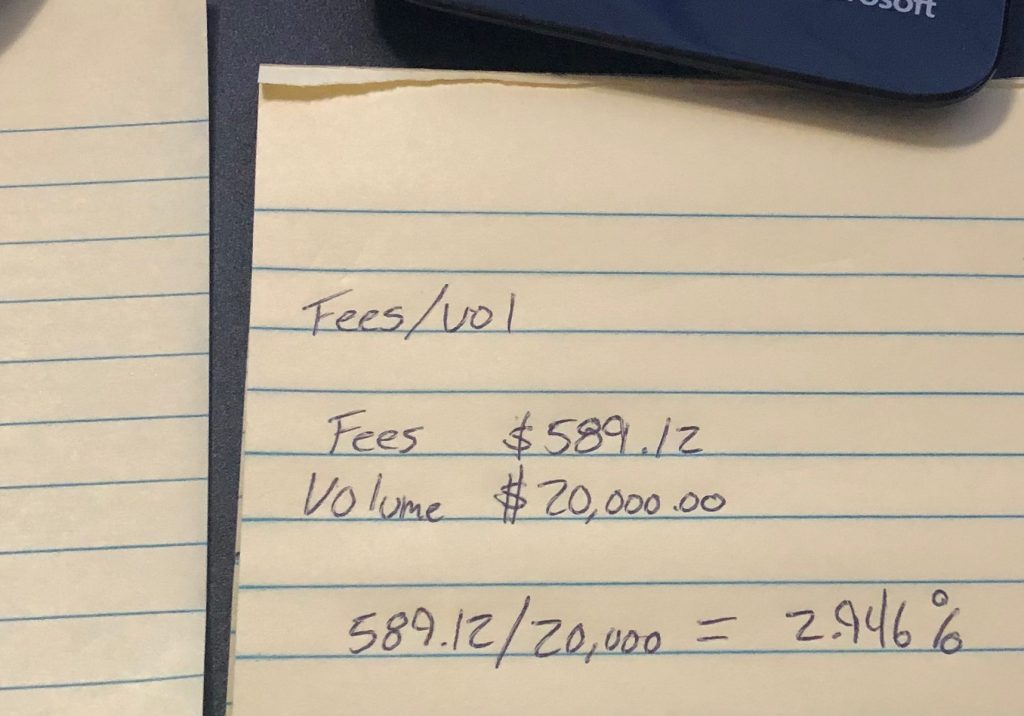

If you don’t have your past account numbers and can’t reach your past sales offices, you can submit your retail sales volume for each year on the claim portal. The settlement group will use that data to better calculate your Visa and MasterCard transaction volume.

Where Can I Get Assistance?

The Payment Card Settlement website has many resources and is continually adding more information. The site also provides phone and email support contact information in the contact section.

You can also find past webinars and additional video resources on their YouTube channel. As of this writing, their most recent webinar is not available yet, but there are three previous ones worth reviewing for additional context, user questions, and website functionality.