February 6th, 2023 by J B

How to tell if you are overpaying for payment processing.

Filed in: Merchant Accounts |

If you are looking for the short answer:

If you are processing less than $3k per month in volume you should be using a payment aggregator like Stripe, Paypal, or Square. If you are processing more than $3k per month you are generally better off with your own underwritten merchant account from a traditional payment processor. The more you process the better off you normally will be with a traditional processor. That said if you have a low average ticket, something under $8.00 you need to pay close attention to any per-item transaction fees like authorization fees. The lower your average ticket is then the more important it is.

This is the longer answer, however, it will be worth the time:

We are going to break this down into multiple posts as it’s going to get quite long. In this post we are going to touch on some information you will want to get ready and have at hand. In future posts, we will go over using your effective rate as a comparison tool and then into additional aspects of your processing that can affect the overall cost. Finally, we will go over some possible changes you can make to help lower your payment costs.

Quick Intro:

There are many different articles out there that go over how to tell if you are paying too much for payment processing. While they have some good rules of thumb I feel there is a better way to cover this topic. Most articles are geared toward generalities, mainly because there are an absolute ton of variables that can affect your processing costs. What we are going to do is break down how you can assess your own business and develop a baseline that you can use to compare against. We will also include some generalities as examples, but the idea here is to make sure you have the tools to better understand the cost of your payment.

Let’s get some data together:

To start we are going to need some data about your business, some things you will know, but others you may have to look up. You are better off starting with a recent past month that is as close to an average month as you can find. Once you choose a month to focus on, let’s make sure you get some key data to have at hand.

You will want to have your monthly processing volume, the total number of transactions, and your total processing fees for that month. If you have a merchant processing statement from that month you should have everything we need. If you do not you can review your bank account and batch reports to compile this data. The bank account should show any fees that were debited from your account throughout the month. Keep in mind that merchant accounts bill behind, so if you are focused on the month of June any month-end fees will have been billed to you around the 3rd of July. The batch reports should give you the information to be able to calculate your total sales volume and the number of transactions. You can also compare the batch reports to the bank deposits to see if any fees are being taken out of your batches before they are deposited.

Having acquired that data we should go ahead and calculate your average ticket by dividing your total sales volume by your total transaction count. For example: if you processed $10,500 over 315 transactions your average ticket is $33.33 Then we also need to calculate your effective rate by taking your total processing fees for the month and dividing them by your total sales volume. Continuing our example if you paid $238.35 in fees for processing $10,500 in volume then your effective rate came out to 2.27%. An effective rate is a nice tool because it accounts for all your merchant processing fees including both transactional and fixed monthly costs.

For now, we are going to focus on the effective rate. Hold on to that other data for our next articles on the topic.

Digging into Effective rates:

Now you have an effective rate, there are many different things we could do. First I would recommend doing that calculation for additional months and not all of those down. Maybe get the effective rate on your highest and lowest volume months.

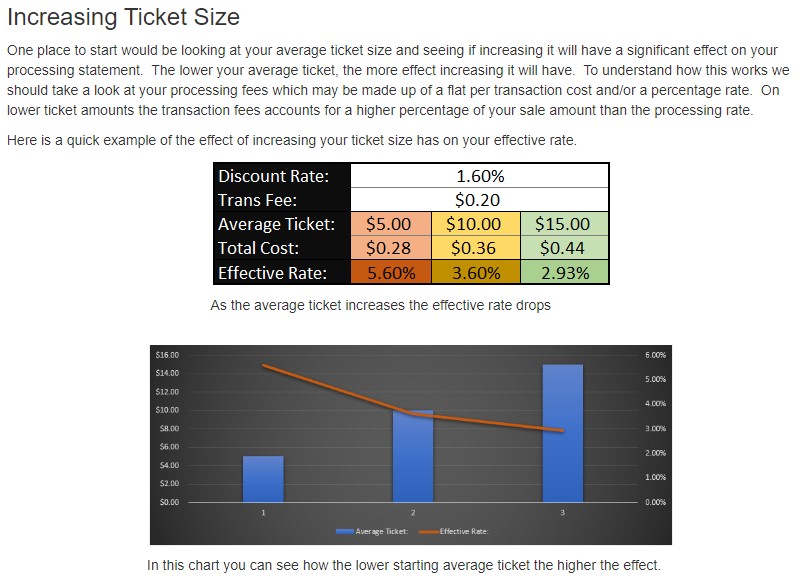

Then we start window shopping. You can pull up the rates from aggregators online by searching for their rates. You can review their rate table and find the way you would be accepting cards through them. Our example business is a retail store that is able to accept 99% of its transactions as EMV or Contactless. If we find that the card’s present rate from that aggregator is 2.89% + $0.10 per transaction with no monthly fees then it starts to be very apparent that our effective 2.27% looks pretty good. On the other hand, if you are a card present business and your effective rate is 3.21% an aggregator starts looking better. That said the additional $0.10 per transaction may offset any savings, but we will have to get into that when we cover the average ticket in an upcoming article.

This is just the starting point, so look for the following few articles to continue breaking down your rates. I recommend calculating your effective rate for a few months and keep monitoring it. We are trying to get a solid understanding of your baseline and how different monthly volumes affect your effective rate.

Your Effective rate is a great tool for you to use to make comparisons between time and processors. While it’s an important foundational tool, there is a lot more to cover. In our next article, we are going to cover comparing your existing statement to another processor quote. The article after that will cover things like average tickets and how they can have a profound effect on your processing costs and of course on your effective rate. Until then if you need assistance understanding your statement we are always here to help. We review merchant statements all the time and have people on staff just to help with processing statements from all processors. Yes, we are probably going to send you our side-by-side breakdown, but there is no pressure to sign up. If the numbers interest you then we are willing to have that talk as well.